Free Online Loan EMI Calculator – Monthly Payment, Interest, Tenure for Home Car Personal Loans in India

Borrowing money is one of the most significant financial decisions many of us make in life, whether it's for purchasing a dream home, buying a new car, funding higher education, or managing unexpected expenses. Loans help bridge the gap between our current savings and future goals, but understanding the repayment structure is key to avoiding financial stress. This is where a reliable free online loan EMI calculator becomes invaluable. It provides instant clarity on your monthly installments, total interest payable, and overall repayment amount without any manual hassle. At CalcZone.in, we offer a powerful yet simple free online loan EMI calculator designed specifically for users in India in , making it the best free online loan EMI calculator for home car personal loans across the country.

The concept of EMI, or Equated Monthly Installment, is central to modern lending in India. Introduced to make repayments predictable and manageable, EMI ensures you pay a fixed amount every month that covers both principal and interest components. With interest rates fluctuating due to RBI repo rate changes and economic conditions in , calculating EMI accurately is more important than ever for anyone searching for a free online loan EMI calculator India . Many people look for terms like "loan EMI calculator online free India" or "best free online loan EMI calculator for home loan in India" because manual calculations using spreadsheets are prone to errors and extremely time-consuming. Our tool eliminates that hassle, using the standard mathematical formula to deliver precise results in seconds for anyone needing a simple loan EMI calculator online free with interest breakdown.

Let's explore why this free online loan EMI calculator India is essential for borrowers. In a country where home ownership is a major life goal for millions, home loans dominate the lending market with long tenures and competitive rates. Current home loan interest rates in hover between 7% to 9.5%, depending on your credit score, lender, and whether it's fixed or floating. For a typical 50 lakh home loan at 8.5% interest rate for 20 years tenure, the monthly EMI comes to around ₹43,391, with total interest exceeding ₹54 lakhs over the period. Seeing these numbers upfront using a free home loan EMI calculator online free India helps you decide if the loan fits your monthly budget or if you need to adjust the loan amount, interest rate, or tenure to make it more affordable.

Similarly, car loans with shorter tenures of 3-7 years and higher interest rates (8-13%) require careful EMI planning to avoid straining your monthly cash flow. Personal loans, often used for weddings, medical emergencies, travel, or debt consolidation, have even higher rates (10-24%) and shorter tenures (1-5 years), making the monthly EMI substantial relative to the borrowed amount. It's crucial to use a personal loan EMI calculator online free India to check affordability before applying. Business loans for entrepreneurs and MSMEs also vary widely in rates and tenures, and accurate EMI estimation using a business loan EMI calculator online free India helps in proper cash flow management and growth planning. Whether you're searching for "free car loan EMI calculator India " or "personal loan monthly EMI calculator online free with interest rate comparison", our tool handles all types of loans seamlessly with high precision and speed.

Free online loan EMI calculator interface – enter amount interest rate tenure for instant monthly payment breakdown in India .

How Does a Loan EMI Calculator Work? The Formula Explained in Simple Terms for Beginners Searching Online Free Tools

The magic behind any good free online loan EMI calculator for home car personal loans is the mathematical formula: EMI = P × r × (1 + r)^n / ((1 + r)^n – 1), where P is the principal loan amount, r is the monthly interest rate (annual rate divided by 12 and 100), and n is the number of monthly installments (tenure in years multiplied by 12). This reducing balance method ensures interest is calculated on the outstanding principal each month, gradually decreasing the interest portion as you pay off the loan over time. For those searching "how to calculate loan EMI manually online free India ", our free online loan EMI calculator with formula shows the math transparently while doing the heavy lifting for you.

For example, take a ₹20 lakh home loan at 8% annual interest rate for 15 years tenure. The monthly interest rate r is 0.006667, n is 180 months. Plugging in the values gives an EMI of approximately ₹19,141. Over the 15 years, you pay about ₹14.45 lakhs in total interest, making the grand total repayment ₹34.45 lakhs. Tools like our best free online loan EMI calculator for home loan in India perform this complex math instantly, also showing total interest payable and grand total payment for better financial understanding and long-term planning.

Many users wonder about floating vs fixed interest rates when using a free online loan EMI calculator with interest rate change simulation. Fixed rates keep the monthly EMI constant throughout the tenure, offering stability. Floating rates are linked to the RBI repo rate and market conditions – the EMI or tenure changes with policy updates. In , with a stable economy outlook, floating rates might be cheaper in the long term for many borrowers. Our free loan EMI calculator for floating rate loan online free India helps model both fixed and floating scenarios for informed choice, making it the best loan EMI calculator with floating rate simulation online free available today.

Step-by-Step Guide to Using Our Free Online Loan EMI Calculator India for Accurate Results

Using the best free online loan EMI calculator for home car personal loans in India is straightforward and user-friendly. First, enter the loan amount you plan to borrow in the loan amount field (in rupees). Next, input the annual interest rate offered by your bank or lender in the interest rate box. Then, specify the loan tenure in years using the tenure input field. Click the calculate button, and instantly get the monthly EMI, total interest payable, and grand total payment amount. For those asking "how to use loan EMI calculator online free for home loan in India ", it's that simple and requires no registration or download.

Let's walk through a real example using our free home loan EMI calculator online free India . Suppose you're buying a house worth ₹80 lakhs and taking a ₹60 lakh home loan at 8.75% annual interest rate for 25 years tenure. The monthly EMI would be around ₹49,500, with total interest over ₹92 lakhs and grand total around ₹1.48 crores. Seeing this breakdown helps you negotiate better interest rates with banks or increase your down payment to reduce the overall burden. This is why millions of users search for "free home loan EMI calculator SBI HDFC ICICI Axis online India" – our independent tool gives unbiased, accurate results faster than individual bank websites.

You can also experiment with different loan tenures using our loan EMI calculator varying tenure online free India . Extending the tenure to 30 years lowers the monthly EMI to around ₹47,000 but increases the total interest to over ₹1.08 crores. Shortening the tenure to 20 years raises the monthly EMI to around ₹53,000 but saves lakhs in total interest payable. This simple loan EMI calculator with tenure change online free India is perfect for such comparisons and finding the optimal balance between affordable monthly EMI and minimum total interest cost.

Different Types of Loans and EMI Calculations in India – Home, Car, Personal, Business, Education Loans

Home loans are the most common type of loan in India, with long tenures up to 30 years and competitive interest rates ranging from 7-9.5% in depending on credit score and lender. Lower monthly EMI but higher total interest over extended time. Our free home loan EMI calculator online free with processing fee and subsidy helps handle additional costs and government benefits for accurate planning in .

Car loans are shorter tenure loans, typically 3-7 years, with interest rates 8-13%. Down payment reduces the principal loan amount, lowering monthly EMI significantly. Many users search "free car loan EMI calculator with down payment online India " – our tool lets you adjust the down payment accordingly for realistic budgeting and on-road price calculations.

Personal loans are unsecured quick disbursal loans but with higher interest rates 10-24%, tenure 1-5 years. Ideal for medical emergencies, weddings, travel, or debt consolidation, but high monthly EMI relative to borrowed amount. Use our personal loan EMI calculator online free with interest rate comparison India to check affordability before applying and avoid potential debt traps in .

Education loans have grace periods or moratorium during study years. Business loans for MSMEs and startups have special government schemes with subsidized rates and longer tenures. In , with the startup boom and digital lending growth, this free business loan EMI calculator online free India is vital for entrepreneurs planning cash flow and growth strategies.

For women borrowers, many banks offer concessional lower interest rates on home, education, and personal loans. Co-applicants like spouse or parents increase loan eligibility and sometimes lower the effective rate. Our free loan EMI calculator for women borrowers online free India simulates these special benefits for accurate monthly EMI estimation.

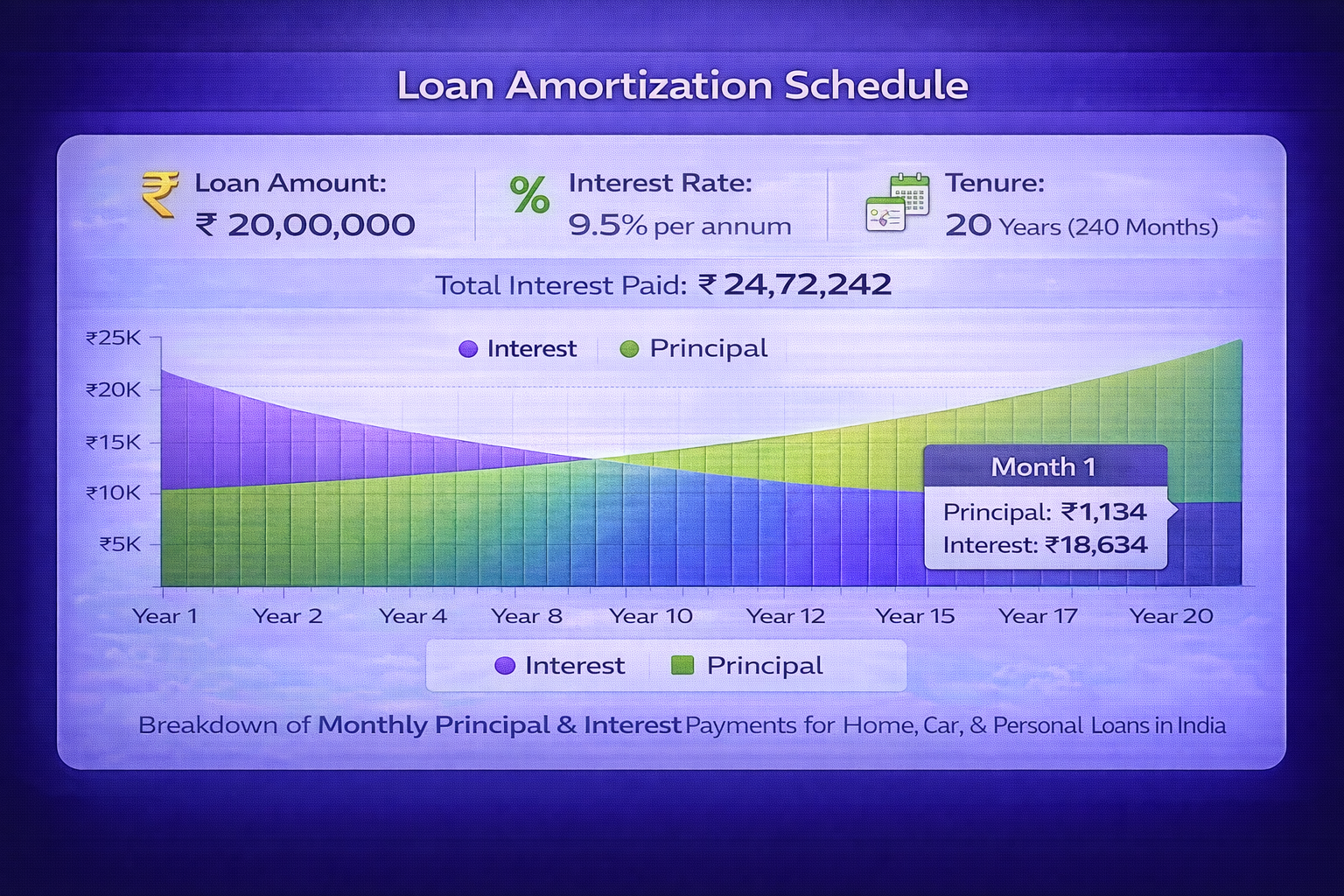

Amortization schedule example – principal and interest reduction over loan life using free online loan EMI calculator with amortization table India .

Fixed Rate vs Floating Rate Loans – Impact on Monthly EMI Calculations in India

Fixed rate loans offer complete stability – the monthly EMI remains the same throughout the entire loan tenure no matter market changes. Good choice in rising interest rate environments for predictable budgeting. Floating rates are linked to the RBI repo rate and external benchmark – the monthly EMI or tenure changes with policy updates and economic conditions. In , with a stable economy outlook and potential rate cuts, floating rates might end up cheaper in the long term for many borrowers searching for free loan EMI calculator for floating rate loan online free India.

Many borrowers opt for hybrid loans – fixed interest rate for initial few years then converting to floating. Calculate both scenarios using our loan EMI calculator fixed vs floating rate online free India to choose wisely and potentially save on total interest payable over the tenure.

Benefits of Using a Free Online Loan EMI Calculator India for Smart Borrowing

The biggest advantage of the best free online loan EMI calculator for home car personal business loans in India is complete empowerment and transparency. You can compare loan offers from major banks like SBI, HDFC, ICICI, Axis, Kotak, PNB without visiting branches or filling forms. Search "free SBI home loan EMI calculator online India " or similar bank-specific terms – our independent neutral tool gives unbiased accurate results faster than individual bank websites and helps you find the lowest EMI option.

It aids proper budgeting – financial experts recommend keeping loan EMI under 40-50% of monthly income for comfortable life and emergency fund. For monthly salary ₹1 lakh, total EMI up to ₹40,000-50,000 is considered safe. This free loan affordability EMI calculator online free India checks if the proposed loan fits your monthly budget and income level.

Prepayment planning is another major benefit – making extra payments or lump sum reduces total interest dramatically as banks allow 20-25% principal prepayment annually without penalty charges. Our free loan EMI calculator with prepayment option online free India shows exact savings when you make additional payments towards principal reduction.

Tax planning for home loans – interest paid deductible under section 24 up to ₹2 lakhs, principal repayment under section 80C up to ₹1.5 lakhs. Calculate net effective monthly EMI after tax benefits using our free home loan EMI calculator with tax benefit online free India for true cost understanding.

The tool builds strong financial literacy especially for first-time borrowers searching "free first time home buyer loan EMI calculator online India". This best free loan EMI calculator app online (web-based responsive) is fully mobile-friendly for calculations on the go during bank visits or property viewings.

Loan EMI for First-Time Home Buyers in India – Complete Guide with Calculator Tips

First-time home buyers often underestimate the total cost of ownership beyond monthly EMI. Factor in property tax, society maintenance, registration charges, stamp duty when planning. In , with rising property prices in metros like Mumbai, Delhi, Bangalore, Pune, Hyderabad, accurate EMI calculation prevents over-borrowing and financial strain. Use free first time home buyer loan EMI calculator online India to plan realistic down payment and monthly budget.

For government schemes like PMAY (Pradhan Mantri Awas Yojana), eligible buyers get interest subsidy or credit linked subsidy scheme reducing effective EMI significantly. Calculate net monthly EMI after PMAY subsidy using our free PMAY home loan EMI calculator online free India for low-income and middle-income groups.

Women home loan borrowers or joint loans with women as primary applicant get concessional lower interest rates 0.05-0.25% from many banks. Co-applicant like spouse or parents increases loan eligibility amount and sometimes lowers the effective rate further. This is particularly helpful for urban millennials and young professionals buying their first home in .

Car Loan EMI Calculations and Practical Tips for Buyers in India

Car prices are rising with premium features, safety upgrades, and EV adoption in India. Car loans cover 85-100% of on-road price including insurance, registration, and accessories. Interest rates lower for electric vehicles in with government FAME incentives and green loan schemes. Use free EV car loan EMI calculator online India to see reduced monthly EMI with lower rates and subsidies for sustainable mobility.

Practical tip: Opt for 5-year tenure instead of maximum 7 years to save substantial interest even if monthly EMI is higher – total cost lower. Our free car loan EMI calculator varying tenure online free India optimizes this choice based on your budget.

Always include RTO registration, comprehensive insurance, and fastag in total on-road price for realistic EMI budgeting using our free car loan EMI calculator with on road price online free India.

Avoid over-borrowing on luxury cars – keep car loan EMI under 15-20% of monthly income recommended by financial planners. Our tool works perfectly for used car loans with slightly higher rates too.

Personal Loan EMI – When and How to Use Wisely in India for Emergencies and Goals

Personal loans are quick unsecured loans ideal for medical emergencies, wedding expenses, foreign travel, home renovation, or credit card debt consolidation. No collateral required but higher interest rates 10-24% from banks and NBFCs. Quick digital approval from fintech lenders. Calculate personal loan EMI online free with interest rate comparison India to see if cheaper than revolving credit card debt at 36-48% annual rates.

For planned expenses like vacations or gadgets, see if monthly EMI fits budget before borrowing. This personal loan monthly EMI calculator with interest online free India helps decide wisely and avoid impulse borrowing.

In , fintech lenders like Bajaj Finserv, Paytm, MoneyTap, Cred offer lower rates and instant approval for good credit scores – use our tool to find the best personal loan EMI calculator for fintech lenders online free India and compare offers.

Impact of Credit Score, Loan Tenure, and Interest Rate on Monthly EMI in India

CIBIL or Experian credit score above 750 gets the best lowest interest rates, resulting in lower monthly EMI and huge savings over tenure. Low credit score means higher rate and higher EMI or even rejection. Improve score before applying for maximum savings. Our tool with interest rate slider simulates "loan EMI calculator based on credit score online free India" scenarios.

Longer loan tenure significantly reduces monthly EMI but dramatically increases total interest payable. Shorter tenure does the opposite – higher EMI but massive interest savings. Our loan EMI calculator changing tenure online free India tests multiple options for the optimal balance between comfortable monthly EMI and minimum total interest cost.

A mere 1% higher interest rate can add thousands to monthly EMI and lakhs to total interest. For loan interest rate EMI calculator online free India , vary rates to see impact and negotiate aggressively with lenders for the lowest possible rate.

General rule: Balance affordable monthly EMI with reasonable total cost paid. Ideal tenure 10-15 years for home loans to minimize interest burden while keeping EMI manageable.

Compare loan offers from banks using free online loan EMI calculator India – lower rate saves lakhs in interest over tenure.

Advanced Features in Our Free Online Loan EMI Calculator India for Professional Planning

Year-wise or month-wise amortization table split – see how interest portion is heavy in early months and principal increases later. Professional for tax planning and tracking. Our free loan EMI calculator with amortization table online India exports PDF for records and bank submissions.

Prepayment impact calculator – extra monthly payments or annual lump sum reduces tenure or EMI significantly with huge interest savings. This free loan EMI calculator with prepayment option online free India shows exact adjusted schedule and savings amount.

Moratorium period options for education or certain business loans – defer EMI payments while interest accrues. Model real scenarios with our advanced tool features.

Comparing Loan EMI Calculators from Banks vs Independent Neutral Tools in

Bank-specific tools like SBI HDFC ICICI Axis Kotak PNB loan EMI calculator online are often biased to show their rates favorably and require form filling. Ours is completely neutral independent. Faster loading, no login required, mobile responsive. This independent loan EMI calculator online free India compares across all lenders accurately without any bias.

Mobile-responsive design for anytime use during bank visits, property viewings, or dealer negotiations. Better than downloadable apps – no storage needed, always updated.

Using Loan EMI Calculator for Smart Financial Planning and Budgeting in India

Financial planners recommend total loan EMI ideally under 40-50% of monthly take-home income for comfortable life, emergency fund, and investments. For monthly salary ₹1 lakh, total EMI up to ₹40,000-50,000 is considered safe limit. This free loan affordability EMI calculator online free India checks if proposed loan fits your income and existing obligations.

Running multiple loans like home + car + personal? Sum all monthly EMIs to see total outflow and debt burden. This multi loan EMI calculator online free India aggregates everything for overall financial health view.

With average inflation 4-6% in India , real purchasing power of fixed EMI decreases over time as salary grows with increments. But factor future expenses like children education, medical, retirement when planning long tenure loans.

Loan Refinancing, Balance Transfer, and Top-Up Loan Calculations in India

Interest rate drop or better credit score? Transfer existing loan to new lender for lower EMI or shorter tenure. Calculate switching cost vs long-term savings using our free loan balance transfer EMI calculator online free India including processing fees.

For top-up loans on existing home loan for renovation, education, or business – add top-up amount to current outstanding, recalculate combined monthly EMI with our free loan top-up EMI calculator online free India.

General rule: Refinance or balance transfer if rate drop >1% and remaining tenure >5 years for maximum net benefit after fees.

Common Mistakes to Avoid When Using Loan EMI Calculator Online Free India

Forgetting bank processing fees 0.5-2% added to effective loan amount increasing EMI slightly. Ignoring compulsory insurance premium for home or car loans. Not accounting income tax benefits for home loans reducing net monthly cost. Over-extending loan tenure for artificially low monthly EMI but paying huge total interest. Always verify calculator inputs and cross-check final figures with lender statements before signing.

Loan EMI Trends and Predictions for Borrowers in India

Home loan interest rates may stabilize around 7-8% with strong economic growth and controlled inflation. Digital lenders and fintech disrupt traditional banks with faster approval and slightly lower rates for excellent credit profiles. Green loans for solar panels, electric vehicles, and energy-efficient homes get cheaper EMI with government incentives and priority sector benefits. Sustainable borrowing is the rising trend in .

With UPI credit lines and open banking ecosystem, personalized loan offers based on transaction history become common – use our tool to compare instantly and get the best deal.

Real-Life User Stories and Success with EMI Planning Using Free Online Loan EMI Calculator India

Rahul used our free online loan EMI calculator with prepayment for his car loan, chose 4-year tenure instead of 7 years after getting annual bonus, and saved 1.5 lakhs in total interest payable.

Neha compared personal loan offers from 5 different lenders using our personal loan EMI calculator online free with interest rate comparison, picked the lowest rate option, and saved ₹50,000 over the 3-year tenure.

A young family refinanced their existing home loan after a repo rate cut, reduced monthly EMI by ₹8,000 using our loan balance transfer calculator online free, and used the extra amount for child's education fund.

An entrepreneur calculated business loan EMI with varying floating rate scenarios, chose floating option, and benefited from subsequent rate cuts saving substantial interest. These real stories from our users show the true power of informed planning with the best free online loan EMI calculator India .

FAQs on Loan EMI Calculators – Most Searched Questions Answered for India

What is the best free online loan EMI calculator India ?

Our tool at CalcZone.in is the most accurate with amortization, prepayment, tenure change, and floating rate simulation features for home car personal business loans.

How to calculate monthly EMI for home loan online free India ?

Enter loan amount, annual interest rate, and tenure in years for instant EMI, total interest, and grand total using standard reducing balance formula.

Can I calculate total interest payable on loan online free with detailed breakdown?

Yes, complete breakdown of principal repayment, interest component, and year-wise or month-wise amortization table shown.

What's the difference between fixed and floating rate EMI calculation online free India?

Fixed rate keeps monthly EMI constant, floating rate adjusts with repo rate changes – simulate both scenarios for long-term planning.

Is there a free loan EMI calculator with prepayment option online free India ?

Yes, input extra monthly or annual lump sum payments to see reduced tenure, lower EMI, and massive interest savings.

How accurate is the loan amortization table in online free calculators?

Highly precise using standard reducing balance method with monthly, quarterly, or yearly split for professional tracking.

How to use car loan EMI calculator with down payment online free India ?

Subtract your down payment from total on-road price before entering the remaining amount as loan principal.

Can I calculate personal loan EMI for different tenures and rates online free?

Yes, change tenure and interest rate to see impact on monthly payment, total interest, and overall cost instantly.

What if interest rate changes during loan tenure – how to recalculate EMI online free?

Input the new revised interest rate along with current outstanding principal for updated monthly EMI estimate.

Is there a free business loan EMI calculator for MSME startup India ?

Our universal tool works perfectly for all loan types including business, MSME, and startup loans with subsidized rates.

How to calculate home loan EMI with tax benefit and subsidy online free ?

Calculate gross EMI first, then manually deduct section 24 interest benefit and section 80C principal for net effective cost, or use subsidy-adjusted rate.

Best free EV car loan EMI calculator India with government subsidy?

Use lower concessional interest rate for electric vehicles and see significantly reduced monthly EMI with FAME incentives.

Free loan EMI calculator for women borrowers with special rate online India?

Input the concessional lower rate offered to women for accurate reduced EMI calculation on home or education loans.

How to use multi loan EMI calculator for home + car + personal online free?

Calculate each separately then sum all monthly EMIs for total debt burden and affordability check.

Financial freedom and achieving life goals start with smart borrowing and precise planning. Use our free online loan EMI calculator India today to make confident, informed decisions for your home loan, car loan, personal loan, business loan, or any repayment plan and build a secure future without unnecessary interest burden.